Do you ever feel like your paycheck just vanishes? One minute your account looks healthy, and the next, it’s been eaten alive by a dozen different bills. It’s a frustrating cycle, but what if I told you that you could break it? Gaining control over your finances doesn’t require a lottery win or a drastic lifestyle change. The secret is to lower your monthly bills through small, consistent, and actionable steps.

You’d be amazed at how a few phone calls and smarter habits can free up hundreds of dollars each year. These aren’t complicated financial theories; they are practical, real-world strategies you can start using today. This guide will walk you through ten simple yet powerful ways to cut expenses, giving you more breathing room in your budget and helping you achieve your financial savings goals faster. Let’s dive in and start saving!

1. Review and Negotiate Your Bills

One of the fastest ways to lower your monthly bills is to tackle the ones you pay without thinking, like cable, internet, and your cell phone. Companies often count on you to “set it and forget it,” but loyalty rarely pays off automatically. It’s time to pick up the phone and become your own best advocate for financial savings.

How to Negotiate for a Better Deal

First, do a little homework. Check out what competitors are offering new customers. This information is your best leverage. Then, call your current provider’s customer service line and politely explain that your bill is higher than you’d like and that you are considering switching to a competitor who offers a better rate.

Often, just the mention of leaving is enough to get you transferred to their “retention” department. These are the people with the power to offer you discounts, promotional rates, or even upgraded services for the same price. Don’t be afraid to ask directly, “Is this the best rate you can offer me?” This simple conversation can easily help you reduce bills by $20, $50, or even more each month.

2. Cancel or Cut Down on Unused Subscriptions

In today’s digital world, it’s incredibly easy to sign up for free trials that quietly turn into monthly charges. From streaming services and fitness apps to subscription boxes and software, these small, recurring payments can add up to a huge drain on your bank account. If you want to lower your monthly bills, it’s time for a subscription audit.

Track and Trim Your Recurring Charges

Go through your last few bank or credit card statements and highlight every recurring charge. Ask yourself two questions for each one: “Do I use this regularly?” and “Do I truly need it?” You might be surprised to find you’re still paying for a service you completely forgot about.

Be ruthless here. If you have three different video streaming services, could you get by with just one or two? Do you really need that premium gym membership when you mostly work out at home? Canceling just two or three unused subscriptions is a fantastic way to save money instantly without feeling like you’re giving anything up.

3. Reduce Grocery Bills Smartly

For most families, groceries are one of the biggest and most flexible budget categories. This means it’s also one of the best places to find significant financial savings. With a bit of planning, you can eat well and still lower your monthly bills dramatically. It all starts before you even set foot in the store.

Your Action Plan for Smarter Grocery Shopping

Meal planning is your secret weapon. Each week, sit down and plan your meals based on what you already have in your pantry and what’s on sale at your local store. Make a detailed shopping list from that plan and—this is the most important part—stick to it! This simple habit helps you avoid impulse buys that bust your budget.

Other great budgeting tips for the grocery store include buying store brands (they’re often identical to name brands), using digital coupons, and buying non-perishable items in bulk when they’re on sale. Also, never shop when you’re hungry. A rumbling stomach makes it nearly impossible to resist expensive snacks and treats you don’t need.

4. Lower Utility Bills at Home

Your utility bills—electricity, gas, and water—can feel non-negotiable, but you actually have a lot of control over them. Making a few small changes to your daily habits can lead to big rewards and is a core strategy to lower your monthly bills. You don’t need to live in the dark; you just need to be a little smarter about your energy consumption.

Simple Tweaks for Big Energy Savings

Start with your thermostat. By setting it a few degrees cooler in the winter and a few degrees warmer in the summer, you can significantly cut expenses on heating and cooling. A programmable or smart thermostat takes this a step further by automatically adjusting the temperature when you’re away from home or asleep.

Look for other opportunities to reduce bills, too. Unplug electronics when they’re not in use or plug them into a smart power strip that cuts power automatically. Seal air leaks around windows and doors with weatherstripping, switch to energy-efficient LED light bulbs, and only run your dishwasher and washing machine with full loads. These small actions compound over time into major financial savings.

5. Switch to a Cheaper Cell Phone Plan

Is your massive cell phone bill eating into your budget every month? For many people, their phone plan is far more than they actually need. If you are serious about your goal to lower your monthly bills, it’s time to re-evaluate what you’re paying for and explore cheaper alternatives that can deliver the same quality of service.: Exploring Your Options Beyond Major Carriers

The big-name carriers spend a fortune on advertising, but they aren’t your only option. Mobile Virtual Network Operators (MVNOs) are smaller companies that use the same networks as the major carriers but offer plans for a fraction of the price. Companies like Mint Mobile, Google Fi, and Visible offer excellent coverage and data plans without the high overhead.

Take a look at your current data usage. Are you paying for an unlimited plan when you only use a few gigabytes each month? Switching to a prepaid plan or a smaller carrier that better fits your actual usage is one of the easiest ways to save money every single month, often cutting your bill in half.

6. Spend Less on Dining Out

We all love the convenience and fun of eating out, but it’s one of the fastest ways to derail a budget. A few meals out per week can easily add up to hundreds of dollars a month. Learning to cook more at home is a cornerstone of any plan to lower your monthly bills and get your finances on track.

Enjoying Food Without the High Price Tag

Make cooking at home an enjoyable experience. Try new recipes, cook with a partner or your family, and make simple, delicious meals. Even if you only replace two restaurant meals a week with a home-cooked one, the financial savings will be substantial. Pack your lunch for work instead of buying it every day for another massive win.

When you do decide to dine out, be smart about it. Look for happy hour specials, use coupons from sites like Groupon, or sign up for restaurant loyalty programs to earn rewards and discounts. You don’t have to give up eating out entirely; you just need to be more intentional about how you do it to successfully cut expenses.

7. Save on Transportation Costs

Whether you drive to work every day or just use your car for errands, transportation costs can take a huge bite out of your income. Between car payments, insurance, gas, and maintenance, the expenses add up quickly. But there are several ways you can lower your monthly bills related to your vehicle.

Driving Down Your Car-Related Expenses

If you have an auto loan, look into refinancing it for a lower interest rate. A better rate could lower your monthly payment significantly. Next, shop around for car insurance. Rates can vary wildly between companies for the exact same coverage, and comparing quotes every year is a crucial step to reduce bills.

To save on gas, combine your errands into a single trip, maintain your vehicle by keeping tires properly inflated, and avoid aggressive driving. For those in urban areas, consider alternatives like public transportation, carpooling, or even biking for shorter trips. Every mile you don’t drive is money saved.

8. Find Free or Discounted Entertainment

Having fun and relaxing doesn’t have to be expensive. It’s easy to fall into the trap of thinking that entertainment means spending money on movies, concerts, or events. However, with a little creativity, you can have a great time and still stick to your goal of wanting to lower your monthly bills.

How to Have Fun on a Budget

Your local community is likely full of free entertainment options. Check out local parks for hiking or picnics, visit your public library for free books and movies, or look for free community events like outdoor concerts or farmers’ markets. Many museums also offer free or discounted admission days each month.

Instead of going out, consider hosting a game night or a potluck dinner with friends at home. This provides a great way to socialize without the hefty price tag of a bar or restaurant. Shifting your mindset about what constitutes “fun” is a powerful tool to save money and enrich your life at the same time.

9. Pay With Cash More Often

In our increasingly digital world, swiping a credit or debit card is second nature. While convenient, it’s also easy to lose track of how much you’re spending. This “invisible” spending can sabotage your efforts to cut expenses. One of the most effective budgeting tips is to reintroduce physical cash into your spending habits.

The Psychological Power of Cash

When you have to physically hand over cash, the transaction feels more real. You see the money leaving your wallet, which makes you more mindful of your purchases. This simple psychological trick can curb impulse buying and help you stick to your budget.

Try using a cash envelope system for variable spending categories like groceries, gas, and entertainment. At the beginning of the month, withdraw a set amount of cash for each category and place it in a labeled envelope. Once the cash in an envelope is gone, you’re done spending in that category until next month. It’s a simple, tangible way to enforce your budget and lower your monthly bills.

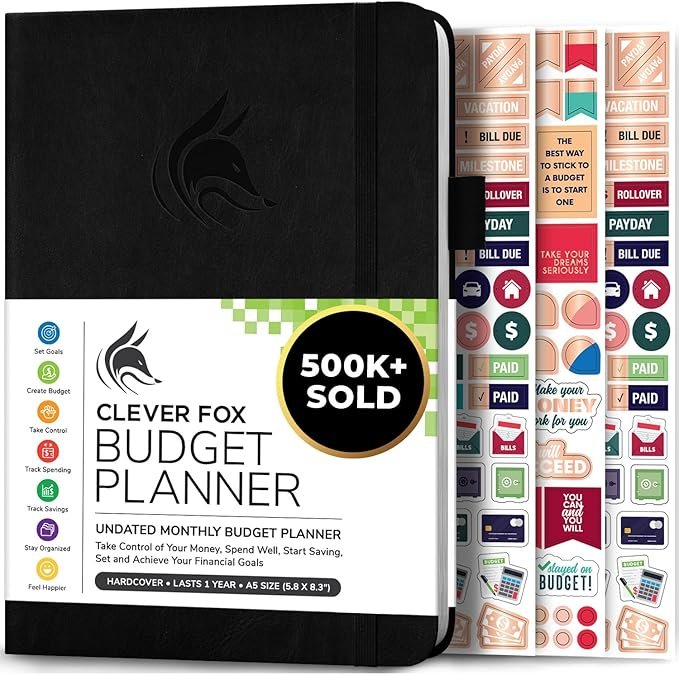

To make this even easier, consider investing in a simple tool to keep you organized. Many people find success using a dedicated budget planner notebook that comes with cash envelopes. You can find great options on Amazon that have dedicated slots for your cash categories, spending trackers, and goal-setting pages. Having a physical planner makes the process more tangible and can help you stay motivated on your journey to cut expenses.

10. Review and Compare Insurance Policies

Insurance is a necessary expense that protects you from financial disaster, but that doesn’t mean you should overpay for it. Like your cable and internet bills, insurance rates are not set in stone. Regularly shopping around for car, homeowners, renters, and even health insurance is essential if you want to lower your monthly bills.

Why Shopping for Insurance Pays Off

Insurance companies are constantly changing their rates and formulas to compete for business. The company that offered you the best deal three years ago might not be the most competitive option today. Your life circumstances may have also changed—perhaps you improved your credit score or have a shorter commute—which could qualify you for lower rates.

Set a reminder to get quotes from at least three different insurance companies once a year. You can do this easily online or by working with an independent insurance agent who can shop around for you. This small time investment can lead to hundreds of dollars in financial savings annually, making it a crucial step to reduce bills.

Final Thoughts on Lowering Your Monthly Bills

Taking control of your finances is one of the most empowering things you can do. As you can see, you don’t need to make drastic sacrifices to make a real impact. The journey to lower your monthly bills begins with small, deliberate actions that add up to significant savings over time.

From negotiating with service providers and canceling unused subscriptions to planning your meals and being smarter about energy use, these ten strategies give you the power to direct where your money goes. The key is to start now and stay consistent. Don’t feel like you have to do everything at once.

If you’re feeling motivated and ready to build on these tips, we’ve created the perfect next step for you. Keep the momentum going by reading our guide: Get Your Finances Back on Track — A 30-Day Plan for September.