Inflation is squeezing wallets in 2025, making high-interest loans feel like a heavy burden. With prices up 3.2% year-over-year ([External Link to Financial Authority on Inflation Data]), managing credit card debt or loans is tougher than ever. You don’t need to stress—smart debt reduction strategies can help you take back financial control. This guide shares easy, actionable steps to tackle high-interest loans and boost your personal finance without feeling overwhelmed.

The Inflation Challenge and Your Debt

Inflation makes everything pricier, from groceries to gas. High-interest loans, like credit cards at 20%+, grow faster when your budget is tight. Paying them off quickly saves you money and stress. Acting now is key to smart debt management.

You might feel stuck, but you’re not alone. X posts show thousands searching for ways to manage debt in 2025. Small steps can make a big difference. Let’s break down how to tackle those costly loans.

Understanding the True Cost of Your Loan

High-interest loans can spiral if ignored. For example, a $5,000 credit card balance at 20% interest adds $1,000 yearly if unpaid. That’s money you could save or spend elsewhere. Knowing the real cost pushes you to act fast.

Use a loan calculator to see your interest over time. Many free ones are available online. This personal finance step shows why debt reduction strategies matter. It’s the first move toward financial control.

Core Strategies for Tackling High-Interest Loans

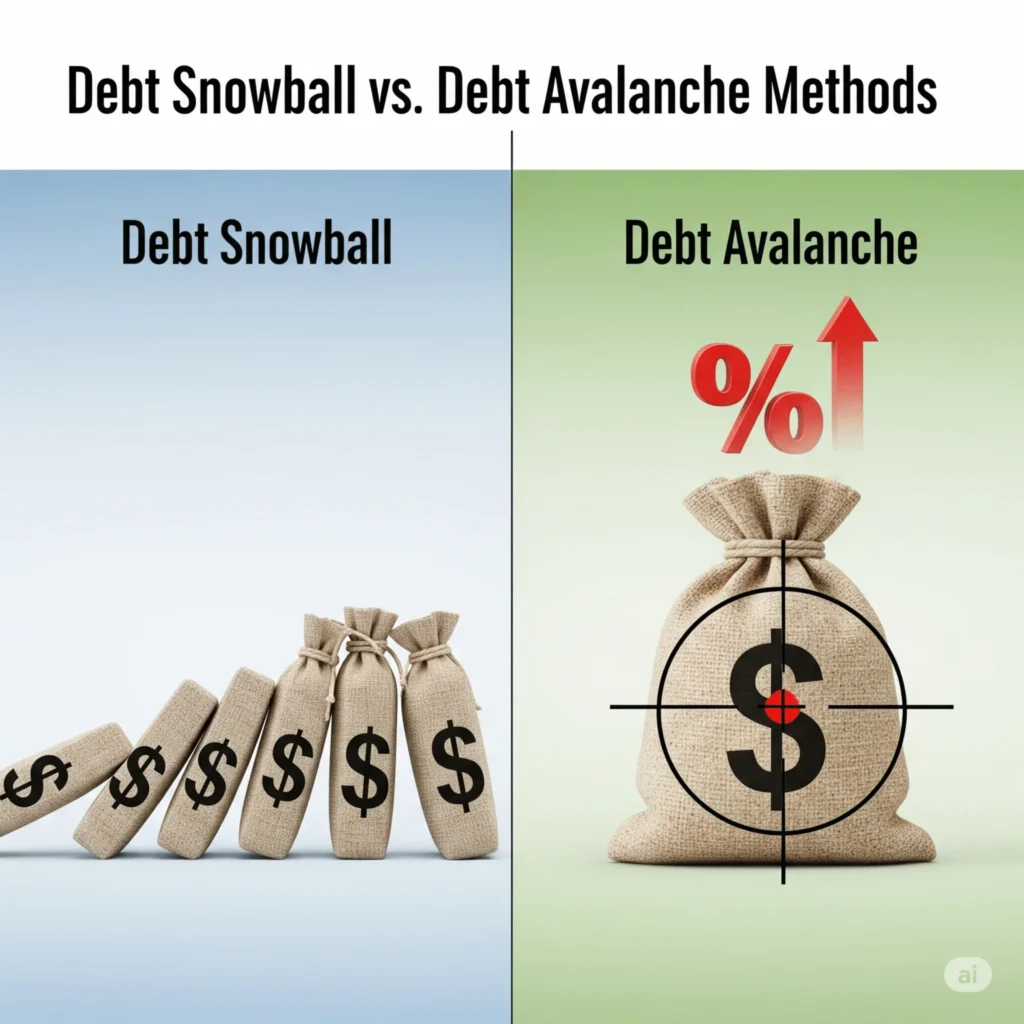

The Debt Snowball vs. Avalanche Method

Two popular debt reduction strategies are the snowball and avalanche methods. The snowball method pays off smallest debts first for quick wins, boosting motivation. The avalanche method targets high-interest loans first, saving more money over time. Pick what fits your style.

For example, if you have a $500 card at 18% and a $2,000 loan at 22%, avalanche starts with the loan. Snowball starts with the card for faster progress. Both help you manage debt effectively.

Loan Consolidation and Balance Transfers

Loan consolidation combines multiple high-interest loans into one with a lower rate. For instance, a personal loan at 10% can replace 20% credit card debt. Balance transfers move credit card debt to a 0% intro-rate card, often free for 12–18 months. Both are smart ways to manage debt.

Check terms to avoid high fees. Consolidation loans from banks like SoFi can save hundreds. Balance transfer cards from Discover are popular on X for debt reduction strategies. Always read the fine print.

Practical Steps for Smart Debt Management

Negotiating Lower Rates on Credit Card Debt

You can lower credit card debt interest by calling your issuer. Ask for a rate reduction, especially if you’ve paid on time. Many issuers drop rates by 2–5% to keep customers. This personal finance trick saves you hundreds yearly.

Practice your pitch: mention loyalty and good payment history. If denied, try again in a few months. Success here boosts your debt reduction strategy. It’s a simple call that pays off.

Boosting Your Payments and Slashing Expenses

Pay more than the minimum on high-interest loans to cut interest costs. Sell unused items, like old electronics, through to raise extra cash. That $50 from selling a phone can go straight to your credit card debt.

Cut small expenses, like $5 daily coffee, to free up $150 monthly. Cook at home or cancel unused subscriptions. These budgeting tips fuel faster debt repayment. Every dollar counts toward financial control.

Final Thoughts on Smart Debt Management

Tackling high-interest loans in inflationary times is doable with the right plan. Use strategies like the avalanche method, loan consolidation, or expense cuts to manage debt. Small actions, like selling items on [Link to Amazon Trade-In Program or Sample Product for Selling], add up fast. Start today to take control of your personal finance and build a brighter future.

Don’t let credit card debt overwhelm you. Pick one step, like calling your card issuer, and act this week. Share your favorite debt reduction strategy in the comments or explore more budgeting tips at EliteOnBudget.com. You’ve got this!