Thinking of ditch credit cards? You’re not alone. For years, the credit card has been the American default for spending, but a quiet revolution is happening. More and more Americans are moving toward straightforward financial tools like debit card benefits and buy now pay later (BNPL) services to regain control. This shift isn’t about going without; it’s about living elite on a budget by avoiding the traps of credit card debt. We’re going to walk you through nine practical, budget-smart steps to make this change and put you firmly on the path to financial freedom.

Why People Are Starting to Ditch Credit Cards

Let’s face it, the traditional credit model is designed to make banks money, often at your expense. High interest rates, hidden annual fees, and late payment penalties are debt traps waiting to spring. When you constantly worry about a bill you can’t fully pay, it creates a crushing emotional burden.

The decision to ditch credit cards often brings an immediate sense of relief. It’s the emotional freedom that comes from knowing every purchase is actually yours, paid for with money you already have. This is a crucial step in developing budget-friendly money habits that last. Once you make the conscious choice to ditch credit cards, you are choosing peace of mind over potential financial stress.

How Debit Cards Help You Stay in Control of Your Budget

The beauty of a debit card is its simplicity. When you spend with a debit card, the money comes directly out of your checking account, instantly lowering your available balance. This makes a clear difference in the debit vs credit debate: you simply cannot spend money you don’t have.

This built-in spending limit is one of the most powerful debit card benefits for anyone looking to budget better. It forces you to be mindful of your purchases in real-time. Instead of putting a large purchase on a credit card and dealing with it later, the immediacy of debit spending encourages better impulse control.

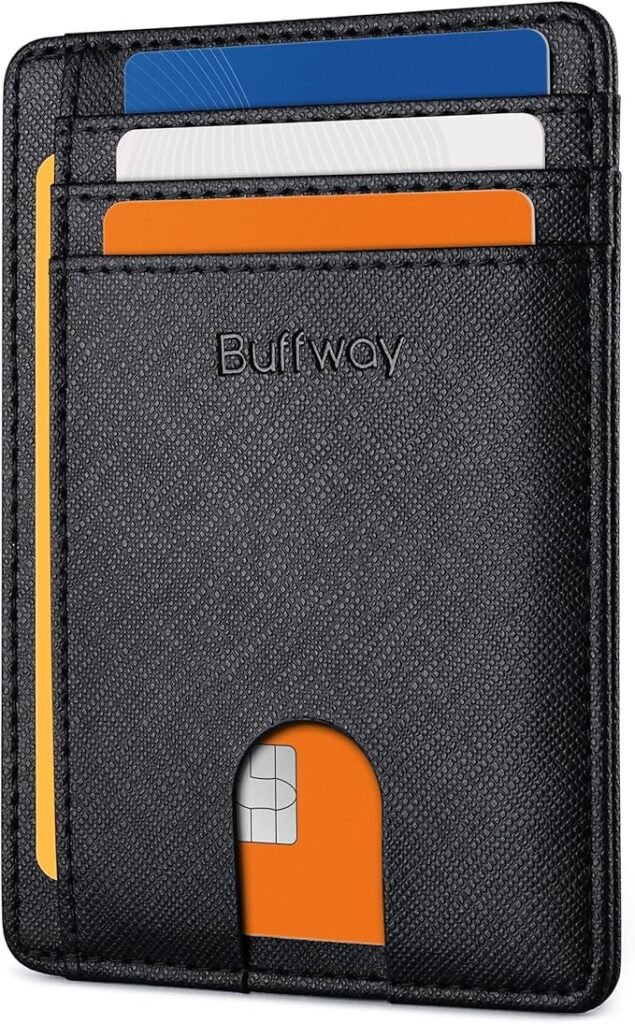

If you want to organize your debit and prepaid cards, try this Amazon cardholder wallet that keeps your essentials sleek and stylish. Keeping your most-used debit card easily accessible is a great habit, and a minimalist wallet helps prevent you from carrying around too many unnecessary cards or receipts. This small organizational step can have a big impact on maintaining your new, simplified financial system.

The Rise of Buy Now, Pay Later (BNPL) — Is It the New Credit Card?

Buy now pay later (BNPL) services like Afterpay, Klarna, and Affirm have exploded in popularity as appealing credit card alternatives. They allow you to split a purchase into four or more installment payments, often without interest, as long as you pay on time. For budget shoppers, it can be a convenient way to manage a necessary, slightly larger purchase without incurring credit card debt.

However, you must weigh the BNPL pros and cons carefully. The “pro” is clearly the zero-interest payment plan, which makes expensive items more digestible. The “con” is the significant risk of overspending because it feels “cheaper” to break up the payment. If you’re not careful, using multiple BNPL plans simultaneously can quickly become an overwhelming stack of mini-debts. If you are serious about your decision to ditch credit cards, you must use BNPL responsibly, treating it as a budgeting tool, not a free pass.

9 Budget-Smart Ways to Ditch Credit Cards and Stay Debt-Free

Transitioning away from the convenience of plastic is an adjustment, but it’s entirely achievable with the right structure. These nine steps focus on building new budget-friendly money habits to ensure you stay firmly on the path to financial freedom. They create a robust system where debit and BNPL become smart tools, not crutches.

1. Track Every Expense Before You Ditch Credit Cards

You can’t fix a problem you don’t understand. Before you swear off your credit cards, spend one month diligently tracking every single dollar you spend—even the $4 coffee. Use a simple spreadsheet or a budgeting app to categorize everything. This exercise is eye-opening and provides the necessary data to build a realistic, debit-only budget. It exposes your spending weaknesses so you can address them head-on.

2. Set Up a Debit-Only Account for Everyday Spending

Consider setting up a separate checking account specifically for your daily expenses like groceries, gas, and entertainment. Transfer your monthly budget for these categories into this account and use only the associated debit card. This hard-line budget boundary prevents you from accidentally dipping into savings or overspending, making the debit vs credit distinction crystal clear. Once the money is gone, you stop spending.

3. Use BNPL Only for Planned, Affordable Purchases

Treat buy now pay later (BNPL) like a cash-flow management tool, not a shopping spree enabler. Limit your use to items you’ve already saved half the money for and that you know you can easily pay off over the short term. Never use BNPL for small, impulse buys like clothes or takeout, and be cautious about using multiple BNPL plans at once. Use it to avoid credit card debt, not to create new small debts.

4. Automate Your Savings Transfers Weekly

One of the greatest debit card benefits is the ability to manage your cash flow aggressively. Set up an automatic transfer to your savings account every time you get paid. Even a small amount, like $50 a week, adds up quickly and prioritizes savings before spending. This simple, automated habit ensures you’re building wealth simultaneously as you ditch credit cards and eliminate reliance on them.

5. Try Digital Budgeting Tools (like Mint or YNAB)

Leverage the power of technology to keep your spending in check. Digital budgeting tools like YNAB (You Need A Budget) or Mint link directly to your accounts and categorize your transactions automatically. They help you visualize your cash flow and alert you when you’re nearing your limits. These apps are invaluable for cultivating budget-friendly money habits by making it impossible to ignore your financial reality.

6. Build an Emergency Fund First

Before you fully ditch credit cards, you need a financial safety net. A fully funded emergency fund—ideally 3–6 months of living expenses—is your insurance policy against unexpected costs. This fund is what prevents you from running back to the high-interest credit card when your car breaks down or you have a medical emergency. It is the cornerstone of achieving genuine financial freedom.

7. Pay Off Existing Balances Before You Ditch Credit Cards

You can’t start fresh if you’re still dragging old credit card debt behind you. Make a focused plan to eliminate any existing high-interest balances as quickly as possible. This may require temporarily cutting non-essential spending to aggressively tackle the debt. Clearing the slate is an essential step that frees up your monthly cash flow, making the transition to debit and BNPL much easier.

8. Reward Yourself with Cash-Back Debit Programs

While credit cards are known for rewards, some checking accounts now offer modest cash-back debit card benefits on purchases. Look for accounts that provide small incentives, like 1% back on qualifying purchases or ATM fee reimbursements. While the rewards won’t be as lavish as those on a travel credit card, they are a nice bonus that reinforces your new, responsible spending habits. Using these credit card alternatives feels good because you are getting rewarded for spending your own money.

9. Learn Smarter Debt Payoff Methods

For anyone serious about escaping credit card debt, having a clear and motivating payoff strategy is vital. Knowing the difference between tackling the smallest balances first (snowball) versus the highest interest rates first (avalanche) can save you time and money. If you’re tackling existing balances, check out our related guide [3 Key Differences: Debt Snowball vs. Debt Avalanche Methods for Paying Off Debt] to find your best strategy. This step-by-step approach gives you a sense of control and accelerates your path to financial freedom.

When You Shouldn’t Ditch Credit Cards Completely

While the goal is to ditch credit cards for day-to-day spending, it’s important to acknowledge where they still shine. For specific financial needs, they can be excellent credit card alternatives if used with extreme discipline.

Many people rely on credit cards for two primary reasons: travel rewards and building a credit history. If you can pay off the full balance every single month without fail, a good travel rewards card can save you thousands on flights or hotels. Furthermore, a history of responsible credit card use is one of the easiest ways to build the credit score necessary to secure low rates on mortgages or car loans later on. Finally, credit cards often offer superior fraud protection compared to debit cards, as the money is the bank’s until the dispute is resolved. If you do keep a card for these reasons, lock it away and use it only once a month for a specific, small bill that you immediately pay off.

Final Thoughts: Ditch Credit Cards but Keep Financial Freedom

Choosing to ditch credit cards is a powerful act of self-empowerment that puts you in the driver’s seat of your financial life. It’s the ultimate move for anyone who wants to truly live elite on a budget. By using the deliberate nature of a debit card and the structured payments of buy now pay later (BNPL), you can create a new reality free from the constant shadow of high-interest credit card debt.

Remember, financial freedom isn’t about having zero debt; it’s about having total control over your money. Commit to these nine budget-friendly money habits and watch your savings grow and your stress disappear. Let’s start today. What’s the first step you are going to take to switch your spending over to debit?