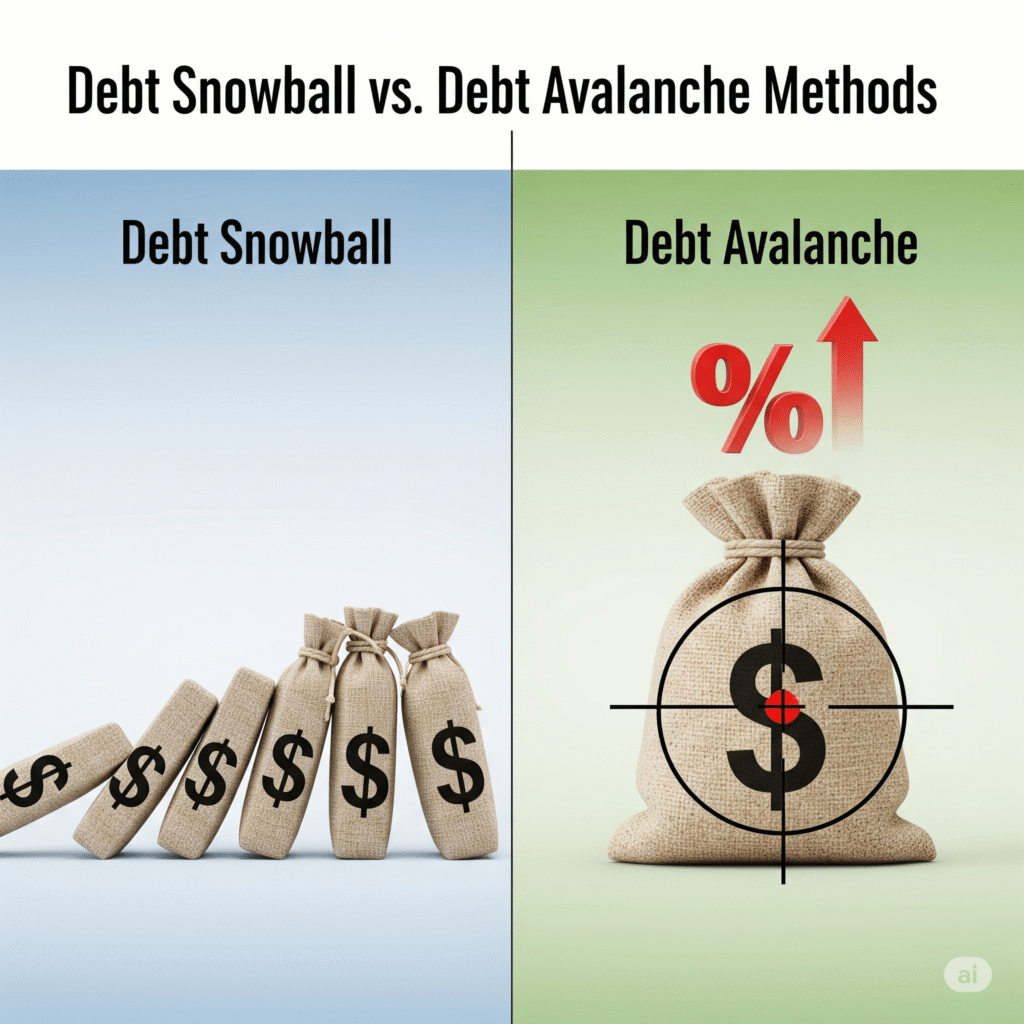

When you’re serious about tackling debt, you’ll likely come across two popular strategies: the Debt Snowball vs. Debt Avalanche Methods. Both are effective ways to get out of debt, but they approach the problem from different angles. Understanding the core differences between these two can help you choose the one that best fits your financial situation and personality.

Let’s break down the three key distinctions between the Debt Snowball vs. Debt Avalanche Methods to help you make an informed decision and start your journey towards a debt-free life.

Difference 1: Order of Debt Repayment

The most significant difference between the Debt Snowball vs. Debt Avalanche Methods lies in the order in which you prioritize your debts.

The Debt Snowball Method’s Order

With the Debt Snowball, you list all your debts from the smallest balance to the largest, regardless of the interest rate. You make minimum payments on all debts except the smallest one, where you throw every extra dollar. This method provides quick psychological wins as you pay off smaller debts first, creating a “snowball” effect of motivation.

The Debt Avalanche Method’s Order

In contrast, the Debt Avalanche method prioritizes debts based on their interest rates, from highest to lowest balance. You make minimum payments on all debts and focus your extra payments on the debt with the highest APR. This strategy is mathematically the most efficient way to save money on interest over the long run.

Difference 2: Psychological Impact vs. Financial Efficiency

The Debt Snowball vs. Debt Avalanche Methods also differ significantly in their psychological impact versus their financial efficiency.

The Psychological Boost of the Debt Snowball

The Debt Snowball method is designed to provide a sense of accomplishment early on. Seeing those smaller debts disappear can be incredibly motivating and help you stay committed to your debt repayment plan, even when the larger debts seem daunting. This psychological boost is a key advantage of the Debt Snowball.

The Financial Savings of the Debt Avalanche

The Debt Avalanche method, while potentially slower to show initial wins, ultimately saves you more money on interest. By attacking the highest-interest debts first, you minimize the total amount you pay over time. For those who are highly disciplined and motivated by numbers, the financial efficiency of the Debt Avalanche is a major draw. To help visualize your progress with either method, consider using a debt payoff tracker whiteboard, available on Amazon. This can provide a tangible representation of your journey and keep you focused on your goals.

Difference 3: Motivation and Long-Term Adherence

Finally, the choice between the Debt Snowball vs. Debt Avalanche Methods can significantly impact your motivation and your ability to stick with your debt repayment plan long-term.

Staying Motivated with the Debt Snowball

The quick wins from the Debt Snowball can provide the momentum needed to keep going, especially for those who might get discouraged by slow initial progress. The feeling of eliminating a debt completely can be a powerful motivator.

Maintaining Discipline with the Debt Avalanche

The Debt Avalanche requires more patience and discipline, as the initial wins might not be as frequent. However, the knowledge that you are saving the most money possible can be a strong motivator for those who are driven by financial logic.

Choosing the Right Method for You

Ultimately, there’s no single “best” method when it comes to the Debt Snowball vs. Debt Avalanche Methods. The right choice depends on your individual circumstances, financial personality, and what keeps you motivated. Consider your priorities – are you driven by quick wins or by saving the most money?

Understanding the core differences between the Debt Snowball vs. Debt Avalanche Methods is the first step towards creating a successful debt payoff strategy. To explore more strategies that can help you improve your overall financial well-being quickly, we invite you to read our article: 7 Side Hustles to Improve Personal Finance Fast.