Budgeting for irregular income is a universal challenge, so if you’re struggling with it, welcome to the club! You’re a freelancer, gig worker, small business owner, artist, or seasonal pro who traded the 9-to-5 grind for flexibility, passion, and the freedom to be your own boss. But that freedom often comes with a side of financial anxiety. How do you plan, save, or even pay your bills on time when you don’t know exactly how much money you’ll make next month?

If the “feast or famine” cycle feels all too familiar, you’re in the right place. The truth is, traditional budgeting advice often fails those of us with an inconsistent income. You can’t just plug numbers into a template and expect it to work.

But here’s the good news: with the right strategy, you can absolutely master your money, build a safety net, and enjoy the financial peace of mind you deserve. This guide provides 7 actionable tips for effective budgeting for irregular income.

Why Traditional Budgeting Fails with Inconsistent Income

For someone with a steady salary, budgeting is a straightforward allocation game. They know $X is coming in on the 1st and 15th, so they can easily assign every dollar to a specific job.

For us, it’s a different world. Our challenge isn’t just allocation; it’s managing extreme volatility. The biggest hurdles include:

- Unpredictable Cash Flow: High-income months can create a false sense of security, while low-income months can trigger panic.

- Difficulty Planning: How do you save for a vacation or a down payment when your income swings by 30-50% month-to-month?

- The Stress of Uncertainty: The mental load of not knowing if you can cover next month’s bills is exhausting.

That’s why you need a flexible system—one built for waves, not a calm lake.

Budgeting for Irregular Income: 7 Essential Tips

Ready to build a budget that actually works for you? Let’s break down the process into actionable steps. This isn’t just theory; it’s a practical framework for freelance budgeting and beyond.

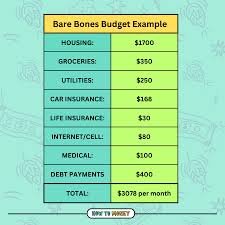

Tip 1: Establish Your “Bare-Bones” Budget for irregular income

Before you can do anything else, you need to know the absolute minimum amount of money you need to survive each month. This is your “bare-bones” or “survival” budget. It’s not about thriving, it’s about covering the non-negotiables.

- List Your Core Necessities: Open a spreadsheet or grab a notebook and write down only your essential living expenses. These typically include:

- Rent or Mortgage

- Utilities (electricity, water, gas, internet)

- Basic Groceries

- Transportation (gas, public transit pass)

- Insurance (health, car)

- Minimum Debt Payments

- Add It All Up: The total is your magic number. This is the amount you must cover every single month, no matter what. Knowing this figure provides a clear, tangible goal for your leanest months.

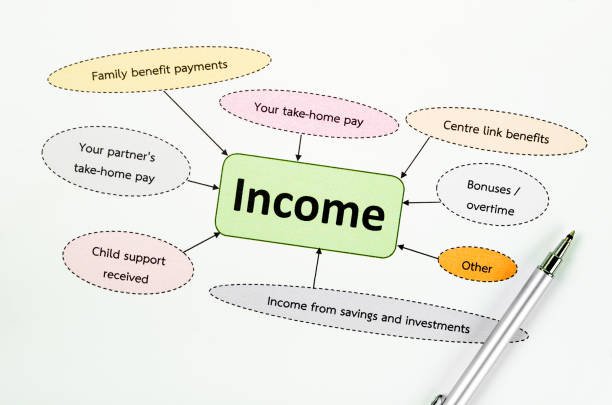

Tip 2: Calculate Your Average Monthly Income

You can’t budget with an income you can’t predict, so let’s create a predictable number from your unpredictable history. Look back at your earnings over the last 6 to 12 months.

- Total your income for that period.

- Divide the total by the number of months (6 or 12).

Example: If you earned $30,000 over the last 6 months, your average monthly income is $30,000 / 6 = $5,000.

The longer the time frame you use, the more accurate your average will be. This average becomes the foundation of your monthly budget. It’s the “salary” you’ll aim to pay yourself.

To dive deeper into creating a reliable budget, even with fluctuating income, check out NerdWallet’s guide on budgeting for irregular income.

Tip 3: Create Separate Bank Accounts

This is one of the most powerful money management tips for anyone with an inconsistent income. It’s a modern take on the envelope system and creates crucial boundaries for your cash. Consider opening at least three accounts:

- Income/Business Account: All your earnings go directly into this account. It’s a holding pen, not a spending account.

- Personal Checking Account: This is your “salary” account. You’ll pay yourself a fixed amount from your Income Account into this one every month to cover your bills and daily spending.

- Savings Account: This is for your emergency fund, sinking funds, and long-term goals.

Tip 4: Pay Yourself a Consistent “Salary”

Using the average you calculated in Tip 2, set up a recurring automatic transfer from your Income Account to your Personal Checking Account. Whether it’s $3,000 on the 1st of the month or $1,500 on the 1st and 15th, this creates the stability your financial life has been missing.

In high-income months, the extra cash stays in your Income Account, building a buffer. In low-income months, you’ll draw from that buffer to still pay yourself the same consistent salary. This simple trick transforms your chaotic cash flow into a predictable paycheck.

Tip 5: Make Your Emergency Fund Non-Negotiable

Budget for irregular earners, savings aren’t just a nice-to-have; they are your primary defense against income droughts. An emergency fund is your shield. It prevents a slow month from turning into a full-blown crisis where you have to take on debt.

- Start Small: Aim to save your first $1,000 as quickly as possible.

- Build It Up: Your ultimate goal should be 3-6 months’ worth of your bare-bones expenses. This cushion allows you to navigate lean periods without stress.

Tip 6: Use Sinking Funds for Big Expenses

Ever get hit with a surprise $600 car insurance bill or a $1,500 tax payment? Sinking funds eliminate these “surprises.” A sinking fund is a mini-savings account for a specific, predictable expense.

- How it works: If you have a $1,200 bill due once a year, you’d save $100 a month ($1,200 / 12) into a dedicated sinking fund. When the bill arrives, the money is already there waiting. This is one of the best personal finance strategies for avoiding debt.

Tip 7: Have a Plan for “Feast” and “Famine” Months

Your income will still fluctuate, but now you have a plan.

- During a “Feast” (High-Income) Month: Your “salary” is paid, and there’s a surplus left in your Income Account. What do you do? Create a waterfall plan:

- Top Up Your Emergency Fund: Get it fully funded first.

- Beef Up Sinking Funds: Get ahead on taxes or other big goals.

- Attack High-Interest Debt: Make an extra payment on credit cards or personal loans.

- Invest: Put a chunk towards your retirement or other long-term goals.

- Treat Yourself: Reward your hard work with a guilt-free splurge!

- During a “Famine” (Low-Income) Month: This is where your system shines. You’ll still transfer your regular “salary” from the Income Account, drawing from the buffer you built during the feast months. Your bills get paid, your stress stays low, and you can focus your energy on landing your next client or project.

Conclusion: You Can Thrive on an Irregular Income

Let’s be clear: budgeting for irregular income is more than possible—it’s empowering. It’s about shifting your mindset from reactive panic to proactive planning.

By following these 7 tips—from calculating your baseline needs to planning for highs and lows—you build the predictability you crave. You are in control. The feast-or-famine cycle doesn’t have to rule your life. With these money management tips, you can build a stable financial future and truly enjoy the freedom that comes with being your own boss.

Ready to take even more control of your finances? Explore more budgeting guides at eliteonabudget.com