10 Budget Worksheet Strategies for Elite Living on a Budget

Welcome, future financial rockstars! Do you dream of that elite lifestyle—the fantastic vacations, the chic wardrobe, the amazing dining experiences? Maybe you think those things are only for the super-rich. Think again. You absolutely can enjoy a high-quality life without sacrificing your financial freedom. The secret? Smart budgeting.

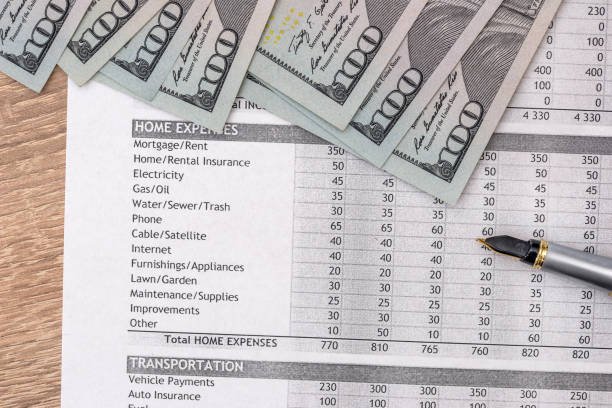

It all starts with an effective budget worksheet. Forget the restrictive, boring spreadsheets of the past. We’re talking about a dynamic tool for financial management. This isn’t about scarcity; it’s about strategic abundance. A good budget worksheet is your blueprint for success. It helps you track where every dollar goes. This allows you to intentionally fund the lifestyle you genuinely desire. Ready to elevate your money management game? Let’s dive into ten strategies for mastering your budget worksheet and achieving true elite living on a budget.

1. The 50/30/20 Rule in Your Budget Worksheet

This is the cornerstone of smart budget planning. The 50/30/20 rule is simple yet incredibly powerful. It divides your after-tax income into three buckets. 50% goes to Needs. This includes housing, utilities, and groceries. 30% goes to Wants. This is your luxury fund for dining out or travel. 20% is for Saving and Debt.

Your budget worksheet needs to reflect this breakdown first. Label columns or sections clearly for each percentage. Tracking these categories is essential for balance. This structure helps you visualize your spending limits instantly. It’s the easiest path to sustainable saving money while still enjoying life.

H3: Setting Realistic ‘Wants’ in Your Budget Worksheet

The ‘Wants’ category is where the elite living happens. Don’t feel guilty about that 30%. It’s your reward for excellent expense tracking. Use your budget worksheet to assign money to things that truly bring you joy. Maybe it’s a high-end coffee maker or weekend trips. Budgeting for joy keeps you motivated to stick to the plan.

2. Implement the Zero-Based Budget Worksheet Method

This strategy ensures every dollar has a job. The zero-based budget means your Income minus your Expenses equals zero. It doesn’t mean your bank account is empty, of course! It just means you have allocated all income.

This level of detail dramatically boosts your financial management. If you earn $4,000, you budget exactly $4,000. Any leftover money must be assigned. Maybe it goes into a special “Travel” fund or an investment account. Using a zero-based budget worksheet eliminates “mystery money.” This is one of the quickest ways to accelerate your saving money goals.

3. The Sinking Funds Budget Worksheet Tactic

Elite living requires preparing for big, irregular expenses. Sinking funds are a crucial part of smart budgeting. These are funds you contribute to monthly for future large purchases. Think annual insurance premiums or a down payment on a luxury car.

Create specific categories in your budget worksheet for these funds. For example, a “Holiday Travel” fund or a “New Laptop” fund. Dividing the total cost by the number of months gives you the monthly amount. This prevents those big bills from derailing your main budget. It’s strategic money management at its finest. You can find this Budget Planner on Amazon to keep your expenses in check. It’s a fantastic physical tool for managing your sinking funds alongside your digital tracker.

4. Weekly Expense Tracking for Precision

Daily or weekly expense tracking is more effective than monthly checks. It keeps your spending habits front-of-mind. You catch problems before they become catastrophes. Pull out your budget worksheet every Sunday evening. Review all transactions from the past seven days.

Looking at small, repeated purchases is key here. That $5 coffee every day really adds up fast. Weekly review allows for immediate course correction. This disciplined approach is a hallmark of great financial management.

H3: Using Technology for Accurate Budget Worksheet Inputs

Today, apps sync directly with your accounts. Use this technology to your advantage. Most apps categorize transactions automatically. Then, you can simply verify them against your main budget worksheet. This saves time and ensures accuracy.

5. The Reverse Budgeting Strategy

Most people budget what is left after spending. Elite budgeters do the opposite. They prioritize saving money first. This is Reverse Budgeting. Immediately allocate your savings and investments right after getting paid.

If your goal is to save 20%, move that 20% right away. The remaining 80% is what you have left to spend on Needs and Wants. This method guarantees you hit your financial goals every month. It’s the most aggressive way to build wealth. Your budget worksheet should place the “Savings” line item near the very top of your list.

6. Conduct a “Subscription Sweep” Audit

Many people bleed cash on unused subscriptions. Think of gym memberships you don’t use or streaming services you forgot about. These “silent killers” undermine all your smart budgeting efforts. Go through your bank statements with a fine-tooth comb.

List every single recurring charge in a separate section of your budget worksheet. Ask yourself if you truly use and value each service. Cancel anything you haven’t touched in a month. This small act can free up a substantial amount for your ‘Wants’ category.

7. Factor In Fun Money (The ‘Splurge’ Line Item)

A budget that is too restrictive is doomed to fail. We are aiming for elite living, not financial misery! Dedicate a specific line item in your budget worksheet just for “fun money” or “splurges.” This is your guilt-free spending cash.

This small, budgeted amount prevents you from blowing your whole plan on an impulse buy. You get to treat yourself within a boundary. It makes living on a budget enjoyable and sustainable. Remember, perfect money management is about balance.

8. The Future-Focused Quarterly Budget Review

Don’t just look backward at what you spent. Look forward! Every three months, schedule a comprehensive review. Go over your past three budget worksheet cycles. Identify trends and predict future needs.

Did you overspend on dining in the last quarter? Adjust that category slightly for the next quarter. Are you planning a big trip next summer? Ramp up your Sinking Fund contributions now. This forward-looking budget planning is what separates the casual saver from the financial elite. For more smart money tips, check out our guide 10 Budget Tracking Tips for Elite Living on a Budget.

9. Segment Your Debt Repayment on the Budget Worksheet

If you have debt, repayment must be a strategic priority. Don’t just make minimum payments. Use your budget worksheet to track your strategy. If you use the Debt Snowball or Debt Avalanche method, label your debt payments clearly.

The Debt Snowball pays off the smallest balance first for a quick win. The Debt Avalanche focuses on the highest interest rate first to save money. Whichever you choose, seeing the goal on your budget worksheet fuels your motivation. Eliminating debt is the fastest way to increase your cash flow.

10. Automate the Budget Worksheet Process

The final strategy is to automate as much as possible. Set up automatic transfers for savings and debt repayment. Schedule bill payments to go out automatically. The less manual effort required, the more likely you are to succeed.

Your budget worksheet becomes a passive system you only check for maintenance. Automation is the ultimate tool for stress-free living on a budget. It frees up your mental energy to focus on enjoying your hard-earned luxury.

Conclusion: Your Elite Financial Blueprint

You now have ten powerful strategies to transform your standard budget into an elite financial blueprint. Mastering your budget worksheet is not about cutting back on everything you love. It’s about being intentional. It is about strategic money management so you can afford what truly matters. Start today. Implement these tips, allocate your money with purpose, and watch your dream life become your everyday reality. True luxury is freedom—go budget for yours!