It’s the dream, right? Sipping champagne wishes on a beer budget. You want to enjoy the finer things in life, but you also want a future where financial stress is just a distant memory. This balancing act of luxury lifestyle on a budget is absolutely possible.

The secret isn’t cutting out all the fun. It’s about being an absolute master of your money. The most successful people know where every single dollar goes. That is why effective budget tracking tips are so essential to achieving your financial goals.

We’re not talking about deprivation here. We’re talking about smart spending, insightful money management, and a chic, organized approach to your finances. Ready to elevate your bank account and your lifestyle? Let’s dive into the 10 actionable budget tracking tips that will get you there.

1. Get Real: Know Your Net Worth

Before you can truly start elite living on a budget, you need a financial baseline. This means calculating your net worth. Don’t worry, it sounds more intense than it is.

Net worth is simply your assets minus your liabilities. Assets include cash, investments, and home equity, while liabilities are your debts like mortgages or student loans. Knowing this number gives you a clear snapshot of your starting point for achieving financial goals. It allows you to track progress, which is a huge motivator for saving money.

2. Adopt a Budget App for Seamless Expense Tracking

The days of paper receipts everywhere are officially over. Modern problems require modern solutions, and a good budget app is non-negotiable for superior expense tracking. These tools are the sleek, digital assistants of your financial life.

Apps like PocketGuard or You Need a Budget (YNAB) link directly to your accounts. They automatically categorize your transactions and show you exactly where your money is going. This automation makes your financial goals feel instantly more attainable.

H3: Auto-Syncing is the Smart Spending Key

You save a ton of time by letting the app do the heavy lifting. The true power of an automated budget app is in the real-time data. It eliminates guesswork and ensures your budget planner is always up to date.

Choose an app with a clean interface that provides good data visualization. If the app is easy to use and looks nice, you’ll actually stick with it. It’s all part of making money management feel less like a chore and more like a high-level strategy game.

3. Implement the Weekly Money Review (WMR)

Consistency is the ultimate mark of an elite financial mind. Set aside 15 minutes every single week for a Weekly Money Review (WMR). This is not just checking your balance; it’s a deep dive into your recent expense tracking.

Look at your transactions and see if they align with your original plan. Did you overspend on dining out? A WMR allows you to adjust your spending for the rest of the month immediately. This prevents a small slip from turning into a budget disaster.

4. Use a Physical Budget Planner Notebook for Intention

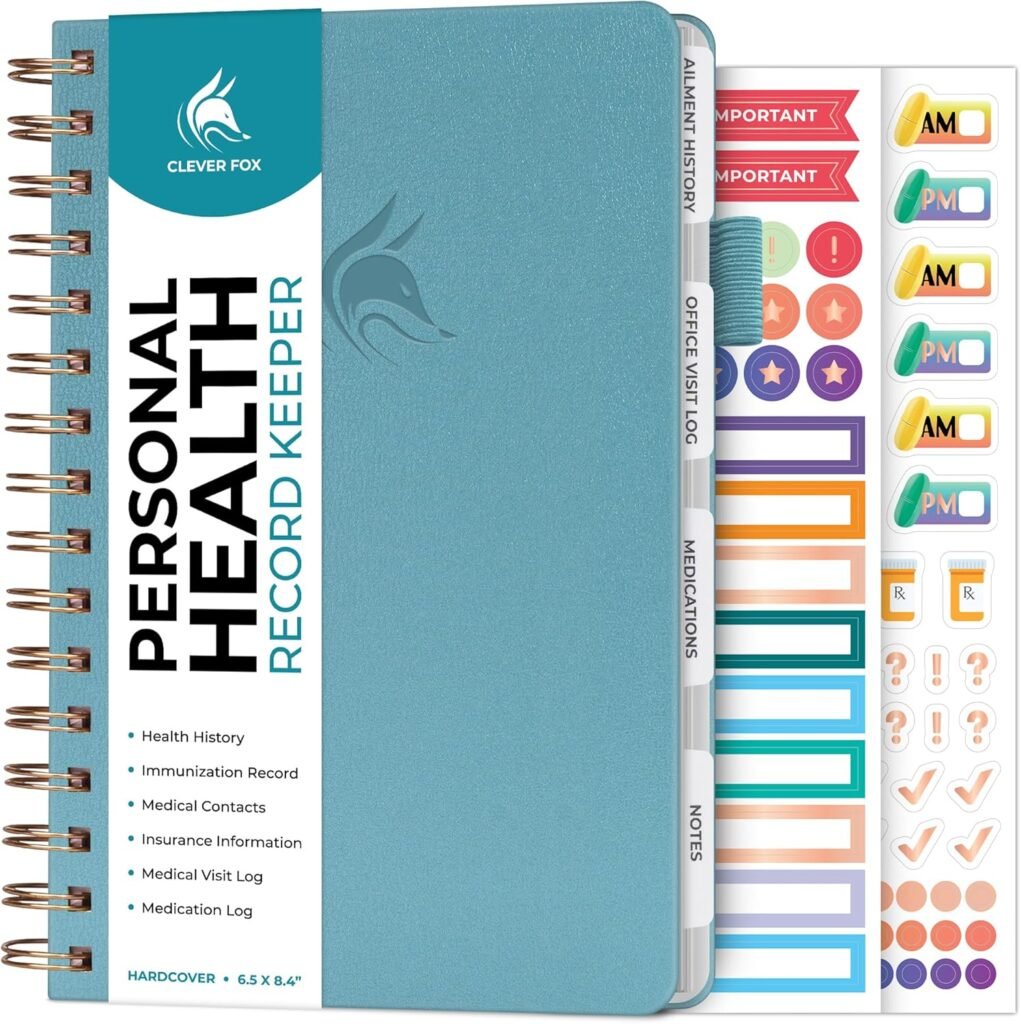

While digital tools are great for tracking, a physical budget planner provides intentionality. Writing down your income and your goals helps solidify them in your mind. It adds a physical, almost ceremonial aspect to your money management.

Consider getting a beautiful, dedicated budget planner notebook. You can find one with pre-made sections for debt, savings goals, and monthly budgets on Amazon. The tactile process of setting up your budget helps you treat your finances with the respect they deserve. You can find this on Amazon.

5. Employ the Zero-Based Budgeting Method

The elite approach to money leaves no dollar without a purpose. That’s the core idea behind Zero-Based Budgeting. Every single dollar of your income is assigned to a category—spending, saving, or debt repayment—until the amount leftover is zero.

This method transforms your money from a mystery into a mission. It forces you to make conscious decisions about your smart spending. It ensures every bit of your income is working toward your long-term financial goals.

6. Master the Art of Category Tagging

Effective expense tracking hinges on accurate data. When you spend, make sure you are tagging that expense correctly. Don’t just lump everything into a vague “miscellaneous” category.

Create specific categories that reflect your true lifestyle, such as “Elite Dining Experiences” or “Self-Care Treatments.” The clearer your categories, the better you can analyze where you need to do a little frugal living and save money. You can’t trim the fat if you can’t see the fat.

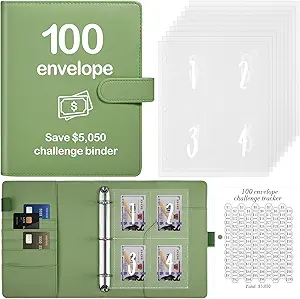

7. Try the Cash Envelope System for “Fun Money”

For categories where you tend to overspend—like entertainment, clothes, or personal shopping—try the cash envelope system. This is a great, old-school technique that provides a physical spending limit. Once the cash in the envelope is gone, you are done spending for that category until the next budget cycle.

You can purchase stylish, labeled cash envelope system wallets on Amazon that make this method feel chic, not cheap. It’s a powerful tool to practice frugal living in high-temptation categories. The physical act of handing over cash creates an immediate awareness of your spending.

8. Automate Your Savings and Investment Goals

The wealthy don’t “try” to save; they automate it. Treat your savings accounts and investment portfolios like non-negotiable monthly bills. Set up automatic transfers to move money to your savings the day you get paid.

This removes the temptation to spend the money first. It is the single most effective way to ensure you are consistently reaching your financial goals. This automated process is the foundation of true wealth building and effective money management.

9. Use Your Budget Data to Inform Your Lifestyle

Your budget tracking tips aren’t just for spreadsheets; they are for making life better. If your data shows you spend a significant amount on last-minute, expensive meals, it’s a sign to adjust your planning. This is the difference between simply tracking and truly mastering your finances.

If you love living elite on a budget, check out our guide on 10 Budget Winter Meals: Soups & Casseroles to Live Elite on a Budget. Meal prepping high-quality, delicious food is a prime example of smart spending that frees up cash for other luxuries. Use your expense tracking data to find similar high-cost areas to optimize.

10. Prioritize Your Elite Spending Categories

When creating your budget planner, make sure you intentionally fund the things that make your life feel elite. If you love travel, allocate a generous amount to your “Travel Sinking Fund.” If you value high-quality clothing, make room for it.

Frugal living doesn’t mean cutting out everything you enjoy. It means cutting out the wasteful, non-essential spending that doesn’t bring you joy (like unnecessary fees or subscriptions) to prioritize your “elite” purchases. This smart spending approach is what makes luxury lifestyle on a budget sustainable.

Conclusion: Your Path to Financial Freedom

Mastering your money is the ultimate form of luxury. By implementing these 10 budget tracking tips, you transition from passively earning and spending to actively commanding your finances. We covered everything from automated expense tracking with budget apps to intentional use of a budget planner and the discipline of the cash envelope system.

Remember, these are not restrictions; they are tools for freedom. By practicing smart spending and disciplined money management, you are investing in a future that is both wealthy and wonderful. Achieve your financial goals and continue living that elite lifestyle on a budget. You’ve got this.