Are you tired of living paycheck to paycheck? Does the thought of investing feel overwhelming, like a complex language you were never taught? You are not alone. For many of us, the path to financial wellness feels shrouded in mystery, a secret club we weren’t invited to join. But what if I told you the password to that club is sitting on a bookshelf, waiting for you?

The single most powerful investment you can ever make is in your own financial education. And the most accessible, high-return way to do that is by reading the right personal finance books. These aren’t just dry textbooks filled with spreadsheets and jargon. The best ones are life-changing guides that re-wire your brain, dismantle your limiting beliefs about money, and hand you a proven roadmap to building a life of financial security and freedom.

Reading a great personal finance book is like having a world-class mentor whispering their best secrets directly to you. It’s the first, most crucial step in taking control of your destiny.

Why Reading Personal Finance Books is a Game-Changer

Before we dive into the list, let’s be clear: knowledge is potential power, but applied knowledge is true power. The incredible value of personal finance books is that they bridge the gap between confusion and action. They do three things exceptionally well:

- Simplify Complexity: They break down intimidating topics like investing, debt reduction, and retirement planning into simple, actionable steps.

- Shift Your Mindset: They challenge your deep-seated beliefs about money, teaching you to see it not as a source of stress, but as a tool for building the life you want.

- Provide a Proven System: They offer frameworks and rules of thumb that have been tested and proven by millions, saving you from making costly mistakes on your own.

These are more than just money management books; they are blueprints for a better future. They are the foundation of financial literacy.

Our Top 10 Best Personal Finance Books for 2025

Whether you’re drowning in debt, a nervous first-time investor, or simply want to optimize your financial strategy, there’s a book on this list for you. Here are the ten best books on personal finance that have the power to change your life.

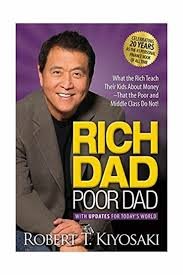

1. Rich Dad Poor Dad by Robert T. Kiyosaki

Summary: This is arguably the most influential personal finance book of the modern era. Kiyosaki tells the story of his two “dads”—his own highly educated but financially struggling father (Poor Dad) and the father of his best friend, a high school dropout who became a self-made millionaire (Rich Dad). The book focuses less on the “how-to” and more on the crucial mindset shift required for wealth.

Key Lessons:

- Assets vs. Liabilities: The rich buy assets (things that put money in their pocket), while the poor and middle class buy liabilities they think are assets (like a primary residence or a new car).

- Financial Education is Key: Your most important asset is your mind. Schools teach you how to work for money, but not how to make money work for you.

- Mind Your Own Business: Focus on building your asset column, not just relying on your paycheck. This is a foundational concept in any collection of wealth building books.

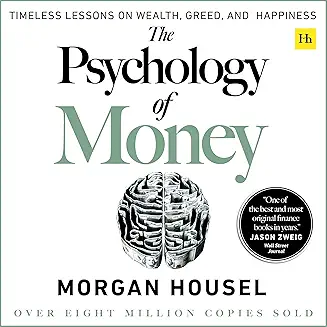

2. The Psychology of Money by Morgan Housel

Summary: Morgan Housel argues that doing well with money has less to do with how smart you are and more to do with how you behave. This brilliant book uses 19 short stories to explore the strange and often irrational ways people think about money. It’s not about what you know; it’s about how you act.

Key Lessons:

- Wealth is What You Don’t See: Real wealth is the expensive car not purchased, the diamond not bought. It’s the financial assets that haven’t yet been converted into visible stuff.

- Embrace Humility and Room for Error: The world is unpredictable. Having a margin of safety (in your budget, your timeline, your investments) is the key to surviving and thriving.

- Your Personal Experience Shapes Your Financial Views: Your relationship with money is unique. Understand your own biases and history before taking financial advice. This is a must-read among financial literacy books.

3. I Will Teach You to Be Rich by Ramit Sethi

Summary: Don’t let the “get rich quick” title fool you. Ramit Sethi’s book is a practical, no-nonsense 6-week program for 20-to-35-year-olds who want to automate their finances and get on with their lives. His philosophy is about spending extravagantly on the things you love while cutting costs mercilessly on the things you don’t.

Key Lessons:

- The Power of Automation: Set up automated transfers to your savings, investment, and bill-paying accounts. This “conscious spending plan” makes good financial habits effortless.

- Focus on the “Big Wins”: Instead of obsessing over $3 lattes, focus on the big wins like negotiating your salary, optimizing your credit, and starting to invest early.

- Start Investing Now: Sethi provides a simple, effective guide to setting up a low-cost, diversified investment portfolio, making this one of the most actionable personal finance books for beginners.

4. The Simple Path to Wealth by JL Collins

Summary: Originally written as a series of letters to his daughter, this book is perhaps the clearest and most compelling argument for a simple, hands-off approach to investing. Collins demystifies the stock market and lays out a straightforward path to financial independence. If other investing books have left you confused, start here.

Key Lessons:

- F-You Money: The ultimate goal is to accumulate enough capital so that you are no longer dependent on a job for survival. This gives you the power to walk away from any situation that no longer serves you.

- The Simple Formula: Spend less than you earn, invest the surplus, and avoid debt.

- VTSAX and Chill: Collins is a huge proponent of investing in a single, low-cost, broad-market index fund (like Vanguard’s Total Stock Market Index Fund) and holding it for the long term.

5. The Total Money Makeover by Dave Ramsey

Summary: If you are struggling with debt, this is your bible. Dave Ramsey offers a tough-love, no-excuses approach to getting your financial house in order. His famous “7 Baby Steps” provide a clear, sequential plan for getting out of debt and building wealth. This is one of the most popular money management books of all time for a reason: it works.

Key Lessons:

- The Debt Snowball: Pay off your debts from smallest to largest, regardless of interest rate. The psychological wins from knocking out small debts build momentum to tackle larger ones.

- Baby Steps: Follow a strict sequence: $1,000 emergency fund, pay off all debt, 3-6 month emergency fund, invest 15% for retirement, college funding, pay off the house, and finally, build wealth and give.

- Behavior Change is Everything: Personal finance is 80% behavior and only 20% head knowledge. You have to get angry at your debt and commit to changing your habits.

6. Your Money or Your Life by Vicki Robin and Joe Dominguez

Summary: This is one of the original manifestos of the Financial Independence, Retire Early (FIRE) movement. The book challenges you to re-evaluate your relationship with “stuff” and work by calculating how many hours of your “life energy” you are trading for every purchase. It’s a profound book that connects your finances directly to your happiness and values.

Key Lessons:

- Calculate Your Real Hourly Wage: Once you factor in commuting, work-related expenses, and de-stressing time, how much are you really earning per hour?

- Track Every Penny: By tracking all money coming in and out, you become hyper-aware of where your life energy is going.

- The Crossover Point: The goal is to reach the “crossover point” where the monthly income from your investments exceeds your monthly expenses, achieving financial independence.

7. The Intelligent Investor by Benjamin Graham

Summary: Endorsed by Warren Buffett as “by far the best book on investing ever written,” this is the undisputed classic. Originally published in 1949, Graham’s philosophy of “value investing” provides a framework for minimizing risk and achieving long-term gains. It’s dense and requires focus, but its lessons are timeless. This is a heavyweight among wealth building books.

Key Lessons:

- Mr. Market: Treat the market like a moody business partner. When he’s euphoric (and prices are high), you can ignore him or sell. When he’s pessimistic (and prices are low), you can buy from him at a discount.

- Margin of Safety: Never overpay for an investment, no matter how exciting it seems. Always buy with a significant buffer between the price you pay and the intrinsic value you calculate.

- Investor vs. Speculator: An investor analyzes a company’s fundamentals and long-term prospects. A speculator bets on price movements. Be an investor.

8. The Richest Man in Babylon by George S. Clason

Summary: This 1926 classic uses a series of charming parables set in ancient Babylon to teach simple, powerful lessons in personal finance. The language is timeless, and the advice is as relevant today as it was nearly a century ago. It’s a short, easy read and a perfect starting point for anyone new to personal finance books.

Key Lessons:

- Pay Yourself First: The “first cure for a lean purse” is to save at least 10% of everything you earn, before you pay any other bills.

- Make Your Gold Work for You: Put your savings to work through wise investments, so your money starts earning more money, creating a stream of income.

- Increase Your Ability to Earn: Seek knowledge and skills to become wiser and more skillful, thereby increasing your earning power.

9. Broke Millennial Takes On Investing by Erin Lowry

Summary: A fantastic, modern guide for a generation saddled with student debt and skeptical of Wall Street. Lowry speaks the language of millennials and Gen Z, breaking down investing in a way that is relatable and not at all intimidating. She covers everything from robo-advisors to socially responsible investing.

Key Lessons:

- You Don’t Need to Be Rich to Invest: You can start with very small amounts of money. The most important thing is to start early and be consistent.

- Understand What You’re Investing In: Lowry provides clear explanations of stocks, bonds, mutual funds, ETFs, and retirement accounts like the 401(k) and IRA.

- Balance Debt and Investing: She provides a practical framework for figuring out whether to prioritize paying down high-interest debt or start investing. It’s one of the best books on personal finance for the modern age.

10. A Random Walk Down Wall Street by Burton Malkiel

Summary: This is another investing classic that has been updated numerous times since its first publication in 1973. Princeton economist Burton Malkiel champions the “efficient-market hypothesis,” which suggests that it’s nearly impossible to consistently beat the market averages. Therefore, the best strategy for most people is to buy and hold a diversified portfolio.

Key Lessons:

- The Power of Diversification: Don’t put all your eggs in one basket. Spreading your investments across various asset classes is the best way to reduce risk.

- Index Funds are Your Friend: For the vast majority of investors, buying low-cost index funds that track the entire market is a more reliable strategy than trying to pick individual winning stocks.

- Manage Your Risk and Your Emotions: Your long-term success as an investor will depend more on your psychological fortitude during market downturns than on your brilliance during market upswings.

Your Journey to Financial Freedom Starts Now

Reading about money is not the same as taking action. But knowledge is the spark that ignites the fire of change. The authors of these personal finance books have dedicated their lives to decoding the world of money so you don’t have to learn the hard way.

Don’t be intimidated by this list. You don’t need to read all ten at once. Just pick one. Pick the one whose summary speaks to your current situation—whether that’s escaping debt, demystifying investing, or changing your entire mindset.

Your journey from financial stress to financial freedom begins with a single page. Open one of these books, and you open the door to a wealthier, more secure, and more intentional life. Your future self will thank you for it.

Ready to take control of your finances and achieve true freedom? Discover these 7 actionable tips for financial freedom in 2025—no matter your age! Dive in now.